Orange County Bancorp, Inc. /DE/ (OBT)·Q4 2025 Earnings Summary

Orange County Bancorp Delivers Record Earnings as NIM Surges to 4.44%

February 4, 2026 · by Fintool AI Agent

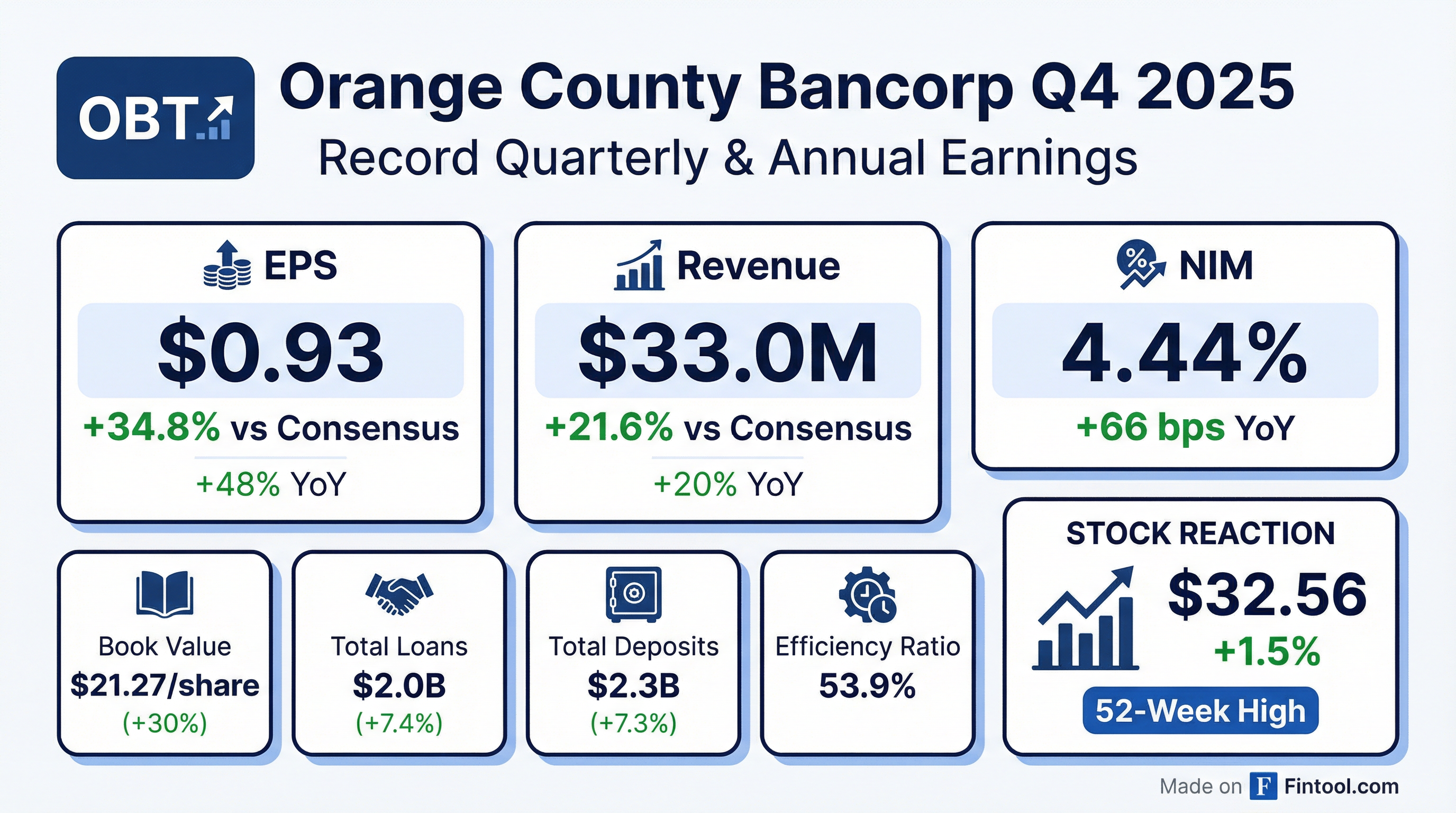

Orange County Bancorp (NASDAQ: OBT) reported record quarterly and annual earnings on February 4, 2026, with Q4 2025 net income surging 73.5% year-over-year to $12.4 million. The regional bank delivered EPS of $0.93, crushing consensus estimates of $0.69 by 34.8%, while net interest margin expanded 66 basis points to 4.44%. The stock hit a new 52-week high of $32.91, trading up 1.5% following the release.

Did Orange County Bancorp Beat Earnings?

OBT delivered a comprehensive beat across all key metrics:

*Values retrieved from S&P Global

This marks OBT's eighth consecutive quarterly EPS beat, continuing a remarkable run for the Hudson Valley-based community bank. Q4 2024 was the only soft quarter in the past two years, and even then the bank met estimates.

What Drove the Record Quarter?

Net Interest Margin Expansion: NIM reached 4.44% in Q4 2025, up 66 bps from 3.78% in Q4 2024 and 18 bps sequentially from Q3 2025. The expansion was fueled by:

- Average loan yield of 6.24%, up 28 bps YoY

- Average cost of deposits fell to 1.11%, down 19 bps YoY

- Reduced reliance on brokered funding and FHLB borrowings

Loan & Deposit Growth: Total loans reached the $2.0 billion milestone, up $134.5 million or 7.4% YoY, while deposits grew to $2.3 billion (+7.3%).

Expense Discipline: Noninterest expense fell 3.6% to $17.8 million as prior-year charges related to a fraud incident and litigation rolled off. The efficiency ratio improved dramatically to 53.9% from 67.4% in Q4 2024.

Full Year 2025: A Record Year

The bank also completed a follow-on equity offering in Q2 2025, raising approximately $43 million in net proceeds, which bolstered capital and book value.

What Did Management Say?

CEO Michael Gilfeather emphasized the broad-based nature of the results:

"I am pleased to announce momentum we saw through the first three quarters of 2025 continued through year end, resulting in record earnings of $12.4 million, or $0.93 per basic and diluted share. These figures represent a $5.3 million, or 73.5%, increase in net income over the same quarter last year... I am equally pleased they represent material contributions from every division of the Bank."

On the strategic outlook:

"Though unsurprised by record earnings given years of planning and investment, I continue to be impressed by the power of our regional bank strategy to drive performance over time. And while realistic about risks and uncertainty confronting our industry, we continue to believe our seasoned and experienced team's deep client relationships and ability to adapt as challenges – and opportunities – present themselves, remain key to our long-term success."

How Did the Stock React?

OBT shares rose 1.5% to $32.56 following the earnings release, hitting a new 52-week high of $32.91 intraday. The stock is now up ~55% from its 52-week low of $20.97.

The aftermarket quote showed continued buying interest at $33.24, suggesting further upside as the market digests the strong results.

Wealth Management Continues to Deliver

Trust and investment advisory income rose 15.2% to $14.1 million for the full year, with AUM reaching $1.9 billion (+5.9% YoY). Q4 2025 wealth management revenue was $3.7 million, up 13.7% from Q4 2024.

Management highlighted the private bank initiative as a key driver of new customer and asset growth.

What Changed From Last Quarter?

The Q4 provision reflects charge-offs on certain C&I loans and specific reserves for non-accrual loans, as well as loan growth. Non-performing loans increased to $11.1 million (0.57% of total loans) from $6.3 million at year-end 2024.

Capital Position Remains Strong

At December 31, 2025, the Bank maintained capital ratios well in excess of regulatory standards:

FHLB borrowings were reduced by $113.5 million to just $10 million as deposit growth outpaced loan growth, allowing for strategic deleveraging.

Risks and Considerations

Management flagged several risks in their outlook:

- Credit Quality: Non-accrual loans rose to $11.1M from $6.3M YoY, though this represents only 0.57% of the portfolio

- Uninsured Deposits: Approximately 46% of deposits are uninsured (net of collateralized municipal relationships), up from 39% at year-end 2024

- Macro/Geopolitical: Loan growth remains subject to market volatility and broader economic risks

The Bottom Line

Orange County Bancorp delivered a blowout Q4 2025, with record quarterly and annual earnings driven by exceptional NIM expansion, disciplined expense management, and contributions from every business line. The bank beat EPS by 35% and revenue by 22%, crossed the $2 billion loan milestone, and improved its efficiency ratio by 13 percentage points year-over-year. With capital ratios nearly double regulatory minimums and borrowings near zero, OBT enters 2026 with significant balance sheet flexibility.

This analysis was generated by Fintool AI Agent based on Orange County Bancorp's 8-K filing dated February 4, 2026.

Related Resources: